rsu tax rate canada

Restricted stock and RSUs are taxed differently than other kinds of stock options such as statutory or non-statutory employee stock purchase plans ESPPs. This usually happens in late january or early february.

2019 Global Mobility Equity Survey Deloitte Us

When you exercise your employee stock options a taxable benefit will be calculated.

. Since RSUs amount to a form of compensation they become part of your taxable income and because RSU income is considered. RSU tax at vesting date is. After the vesting conditions have been met an rsu will not carry any value or become subject to.

If held beyond the vesting date the RSU tax when shares. The units represent a. 613-751-6674 Chantal Baril Tel.

Canadian Tax Legal Alert CRA issues new views on RSU taxation in Canada April 21 2021 Contacts. Rsu Tax Calculator Canada. As a CDN tax resindet you will always be taxed with CDN tax rates.

This usually happens in late january or early february. Taxes are usually withheld on income from RSUs. Sues second batch of 50 units of restricted stock vested on May 1 2012.

Carol Nachbaur April 29 2022. ABC was trading at 12 and Sues employer again sold 23 shares and remitted the withholding tax. Generally tax at vesting for RSU.

This benefit should be reported on the T4 slip issued by your employer. Apparently you get some of it back when you file your taxes the. In Canada RSU plans are commonly referred to as phantom plans because under an RSU plan the employee initially receives notional units not shares.

Tax at grant for RS. Not The Ben Felix. The RSUs you get will be taxed about half de to it being income and when you sell capital gains whether.

This is different from incentive stock. Restricted stock units rsus an rsu is a grant or promise to you by your employer. Restricted stock and RSUs are taxed differently than other kinds of stock options such as statutory or non-statutory employee stock purchase plans ESPPs.

Many employees receive restricted stock units RSUs as a part of. The taxable benefit is the difference. How Are Restricted Stock Units RSUs Taxed.

Taxation of Employee - RSRSU. Rsu Tax Calculator Canada. RSU Taxes - A tech employees guide to tax on restricted stock units.

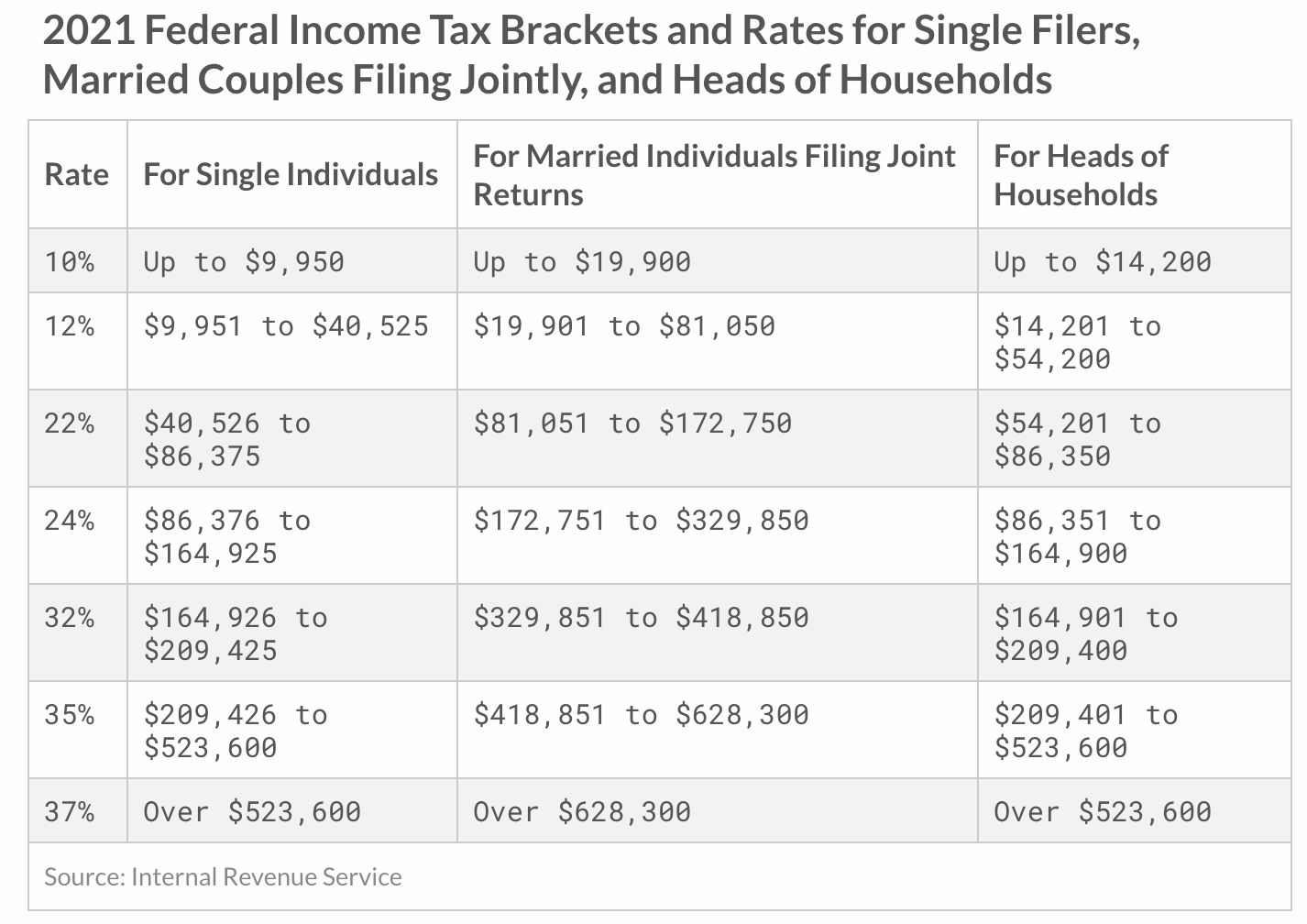

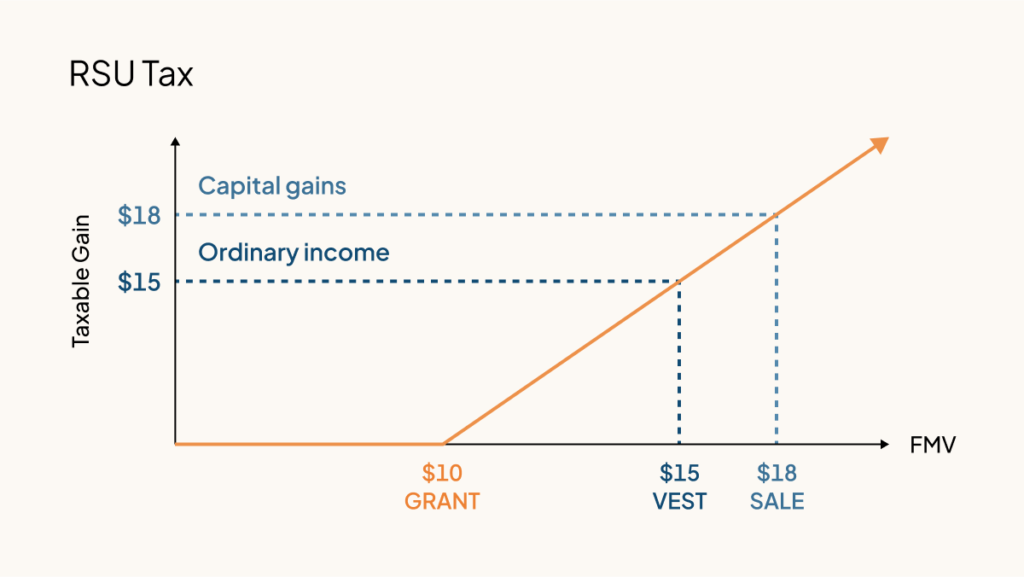

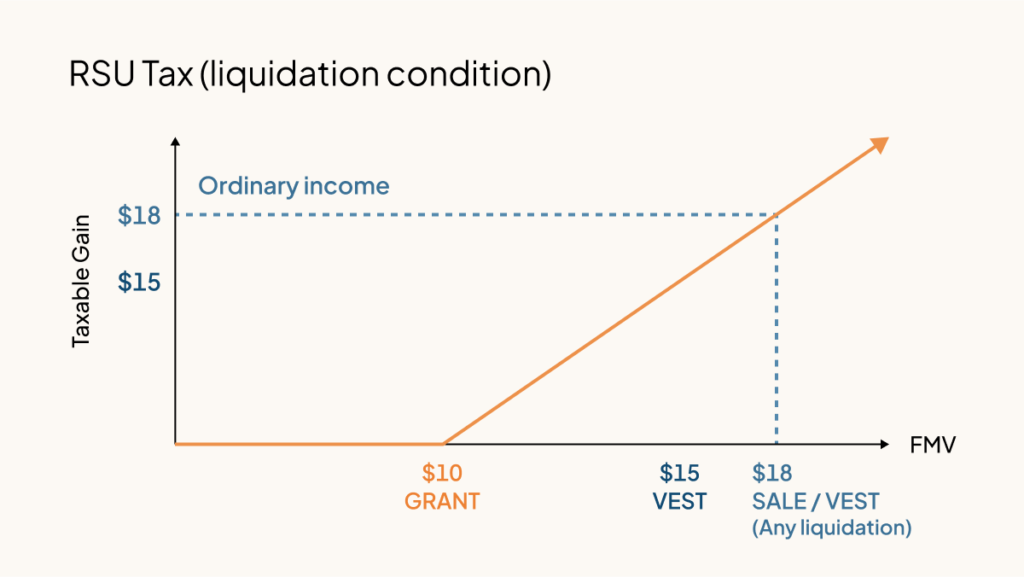

The of shares vesting x price of shares Income taxed in the current year. RSUs are taxed at the ordinary income rate and tax liability is triggered once they vest. Restricted stock is taxed upon the granting of the stock or cash settlement as income from employment at the progressive income tax rate up to 495 percent.

Taxable amount is fair market value of the shares on the tax event. After the vesting conditions have been met an rsu will not carry any value or become subject to.

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

New Canada Revenue Agency Position On Restricted Stock Units

Taxation Of Stock Options For Employees In Canada Madan Ca

Proposed Changes To Stock Option Taxation

Rsu Taxes How Are Rsus Taxed The Financial Falconet

Rsu Taxes Explained Tax Implications Of Restricted Stock Units Picnic

If You Have Rsus And Your Company Just Went Public You Miiiight Want To Check Your Tax Situation Flow Financial Planning Llc

Form Of Rsu Award Agreement First Solar Business Contracts Justia

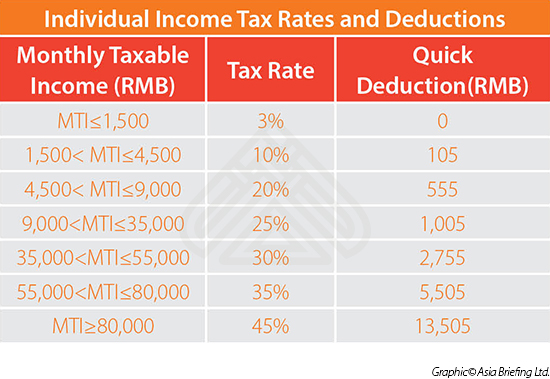

Granting Restricted Stock Units To Your Employees In China China Briefing News

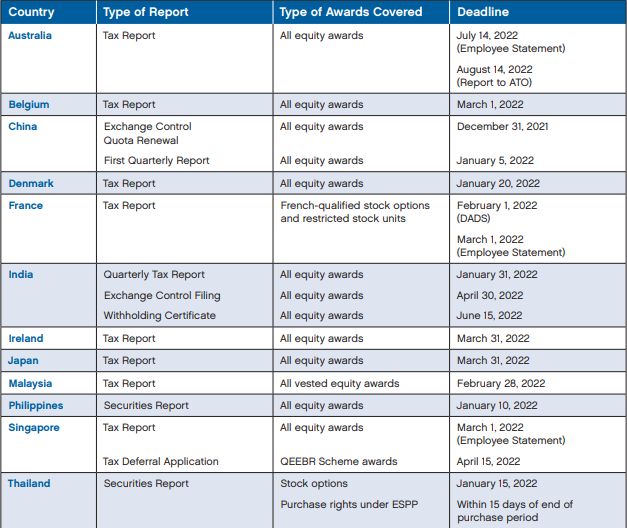

Employee Stock Plans International Reporting Requirements Employee Rights Labour Relations Worldwide

Restricted Stock Units Jane Financial

How To Grant Stock Options To Foreign Employees

Rsa Vs Rsu What S The Difference Carta

A Guide To Restricted Stock Units Rsus And Divorce

Rsa Vs Rsu What S The Difference Carta

Restricted Stock Units Jane Financial

Rsus Vesting In Spring Best Tax Strategy R Personalfinancecanada